Chemical fiber is closely related to oil interests. More than 90% of the products in chemical fiber industry are based on petroleum raw materials, and the raw materials for polyester, nylon, acrylic, polypropylene and other products in the industrial chain are all sourced from petroleum, and the demand for petroleum is increasing year by year. Therefore, if the price of crude oil drops significantly, the prices of products such as naphtha, PX, PTA, etc. will also follow suit, and the prices of downstream polyester products will be indirectly pulled down by transmission.

According to common sense, the decrease in raw material prices should be beneficial for downstream customers to purchase. However, companies are actually afraid to buy, because it takes a long time from the procurement of raw materials to the products, and polyester factories need to order in advance, which has a lag process compared to the market situation, resulting in the product devaluation. Under such circumstances, it is difficult for a business to make a profit. Several industry insiders have expressed similar views: when enterprises purchase raw materials, they generally buy up rather than down. When the oil price drops, people are more cautious about purchasing. In this situation, it not only exacerbates the price drop of bulk products, but also directly affects the normal production of enterprises.

Key information on the spot market:

1. The international crude oil futures market has fallen, weakening support for PTA costs.

2. The PTA production capacity operating rate is 82.46%, located near the high starting point of the year, with sufficient supply of goods. PTA's main futures PTA2405 fell by more than 2%.

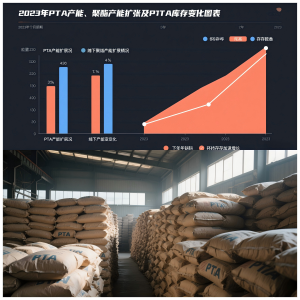

The accumulation of PTA inventory in 2023 is mainly due to the fact that 2023 is the peak year for PTA expansion. Although downstream polyester also has a capacity expansion of millions of tons, it is difficult to digest the increase in PTA supply. The growth rate of PTA social inventory accelerated in the second half of 2023, mainly due to the production of 5 million tons of new PTA production capacity from May to July. The overall PTA social inventory in the second half of the year was at a high level in the same period of nearly three years.

Our company engaged in polyester staple fiber, for further information about our products or to discuss potential collaborations, please contact our sales team at [email protected] or visit our website at https://www.xmdxlfiber.com/.

Post time: Jan-15-2024